Enterprise Risk Management Framework (Image by NAEM ORG)

Enterprise Risk Management Framework (Image by NAEM ORG)

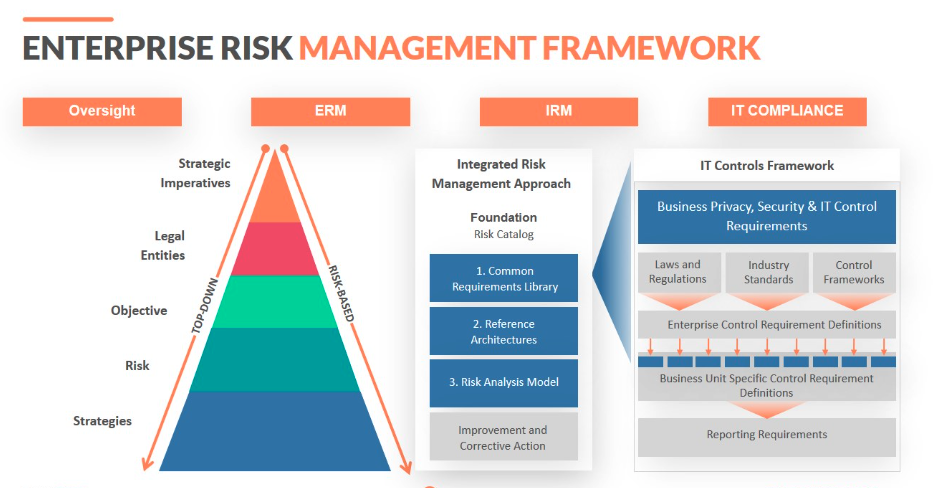

Enterprise risk management is a comprehensive framework used by organizations to identify, assess, manage, and monitor risks that can impact their objectives. This enterprise risk management framework is integral for businesses to maintain resilience and achieve strategic goals.

With the Enterprise Risk Management (ERM) framework, organizations are better equipped to identify potential risks early on, assess their impact accurately, and respond effectively.

This proactive stance on risk management is crucial for sustainable growth and stability. ERM framework offers a uniform process to handle risks across various departments of an organization.

This coherence ensures that risks are not viewed in isolation but in relation to the overall impact on business.

Implementing ERM also enhances decision-making, as it provides a clear picture of risk exposure and potential consequences, allowing businesses to make informed choices.

So, here’s the deal. Let’s talk about ERM and actually get into it. We want to share the nitty-gritty, the inside scoop, so you can build an ERM framework that really works for your business.

It is our hope that you will use this resource as a starting point for the creation of a solid, effective ERM strategy that will keep your business thriving no matter what comes your way. Are you ready to get started?

An enterprise risk management framework is a structured framework that provides a comprehensive road map for identifying, analyzing, managing, and reporting on all types of risks that an organization faces.

Unlike traditional risk management, which often deals with risks one by one, ERM looks at the big picture.

So, what makes ERM stand out? First, it’s comprehensive. ERM doesn’t just focus on one type of risk; it considers everything from financial risks to IT security, and even things like reputation and compliance.

This broad scope is crucial because it helps businesses see how different risks are connected and how they can impact the entire organization.

Another key aspect of ERM is its role in strategic decision-making. With ERM, companies can understand the potential impact of various risks on their long-term goals, which helps them make smarter decisions.

ERM also differs from traditional risk management in its proactive nature. Instead of just reacting to problems as they arise, ERM involves identifying potential risks early and planning how to handle them.

But here’s the kicker: there’s no one-size-fits-all ERM framework. You’ve got to find what works for your unique business. And that means thinking about a few key things:

But, it’s impossible not to bring up risk management techniques in our ERM framework discussion – they’re like two peas in a pod.

The ERM framework sets the stage – it gives you the big picture and ensures that every risk management effort is aligned with the overall goals and strategies of your organization.

Meanwhile, the risk management techniques are where the action happens. They are applied within the guidelines of the ERM framework to tackle specific risks.

That’s exactly why we put together a handy guide on risk management techniques. It’s the perfect partner to your ERM framework knowledge, helping you get a grip on both the big picture and the nitty-gritty details.

Have you heard about The Casualty Actuarial Society, or CAS for short? They’re like the go-to experts when it comes to Enterprise Risk Management (ERM) frameworks.

CAS is known for their in-depth knowledge, really high standards, and a practical approach that covers pretty much everything you need to know about ERM.

What makes CAS stand out is their ability to issue ERM frameworks that are super comprehensive.

ERM by CAS tackling every category of risk that a business could face, making sure nothing slips through the cracks.

They break down ERM into four main categories of risks. Let’s look at each one and see what they’re all about.

First up, strategic risks. Imagine the big-picture stuff – the risks that can throw your whole organization’s goals and direction off course.

We’re talking about shifts in the market, tough competition, changing customer tastes – all that jazz. If these aren’t managed right, they could really shake up your ability to hit your targets.

Then, there’s operational risks. This is the day-in, day-out stuff. It’s about the risks lurking in your daily operations, from the people you work with to the systems you use.

Things like supply chain hiccups, tech glitches, or issues with your team. It’s all about keeping the engine of your business running smoothly.

Don’t forget financial risks. This is the money talk – risks related to your finances, like sudden changes in interest rates, the danger of borrowers not paying up, or not having enough cash flow. Keeping a handle on these risks is key to keeping your financial health in check.

Last but not least, compliance and regulatory risks. This is all about playing by the rules. If you’re not up to date with laws and regulations, you could face some serious trouble, like legal action or damage to your reputation. This is about staying in line with the standards of your industry.

So there you have it – CAS’s take on ERM, broken down into four critical areas to keep your business on track and out of trouble.

The best ERM framework is the one that aligns with your organizational needs, is effectively implemented, and fosters a strong risk management culture.

So, that’s why we’ve got a couple of big names in the ERM world. Remember the four categories from CAS (Casualty Actuarial Society)?

They’re pretty awesome for diving deep into different risk types. But that’s not the only way to look at ERM.

The Committee of Sponsoring Organizations of the Treadway Commission (COSO) is another global standard for ERM frameworks.

COSO emphasizes top-notch corporate governance, financial reporting, and internal controls. Their ERM framework consists of eight components.

The COSO Enterprise Risk Management (ERM) framework is a widely recognized tool that assists organizations in identifying, assessing, and managing all types of risks they face.

You might be wondering, “Why all these different frameworks?” Well, here’s the deal: every industry and company size has its own set of risks.

What works for a tech startup might not cut it for a manufacturing giant. That’s why having a one-size-fits-all ERM framework just doesn’t work.

CAS is a big hit, especially in the insurance world. They use their super deep actuarial knowledge to craft a framework that zeroes in on the risks insurers face.

On the other hand, COSO offers a broader, more versatile framework. It’s like the Swiss Army knife of ERM frameworks. Companies from all sorts of industries can take it and tweak it to fit their unique risk landscape.

So, whether you go with CAS or COSO, or another framework, the key is to choose one that fits your organization like a glove.

Now, let’s begin discussing the 8 components of the COSO ERM framework below to gain a better understanding.

The internal environment in the COSO ERM framework is about building a strong, risk-aware culture where everyone understands their role in managing risk, and ethical values guide the way.

More less, the internal environment is about the culture of your organization, but it goes a bit deeper than just the general vibe. It’s about how your company thinks about, approaches, and handles risk.

Why is all this important? Well, a strong internal environment means you’re better at spotting risks, making smart decisions, managing risks proactively, and being resilient when things get tough. It’s like building a solid foundation for your organization.

So, how do you build this environment? Start with your leaders – they need to set the tone. Keep communication open and make sure everyone feels comfortable talking about risks.

Invest in training your team so they’re up to the challenge. And remember, your internal environment isn’t set in stone; it should evolve as your organization and the world around it changes.

Objective setting in ERM means aligning your goals with your risk appetite. It’s like saying, “Here’s what we want to achieve, and here’s how much risk we’re okay with taking to get there.”

This balance is crucial. Set goals that are too risky, and you might overextend. Too cautious, and you might miss out on great opportunities.

This process starts with defining your “why.” What are your targets – increased sales, market dominance, efficiency? Knowing your destination helps identify the risks that could throw you off course.

Then, you must consider the risks. They’re not all equal. By aligning them with your goals, you know which ones deserve more attention.

Resource allocation is another critical aspect. Understanding your goals, you can channel resources effectively.

And don’t forget about tracking progress. Your goals are like milestones on a map, helping you gauge how well you’re navigating and managing risks.

To make this effective, clarity is key. Define specific, measurable goals. They’re your stars to navigate by.

Communication is vital too. This means everyone on board, from the CEO to the staff, should understand the objectives.

Lastly, be ready to adapt. Regularly revisiting and revising your objectives ensures they remain relevant and achievable.

Event identification is about scanning the horizon and understanding the potential events that could affect your organization, so you can plan and prepare accordingly.

This event identification phase is not just about looking out for trouble; it’s also about recognizing opportunities. The process of event identification is more like creating a mind map of “what ifs.”

What if a new competitor enters the market? What if there’s a technological breakthrough? These events could be risks or opportunities, depending on how you’re prepared to handle them.

The goal here is to be aware, not just of obvious risks like financial downturns or cyber threats, but also of less apparent ones like regulatory changes or shifts in customer preferences.

But event identification isn’t just a one-person job. It requires input from across the organization.

Different departments might see different risks or opportunities. For instance, your IT team might spot technology risks that your marketing team wouldn’t.

Once you’ve identified these potential events, the next step is to figure out how they could affect your organization.

This helps in prioritizing which risks or opportunities warrant more attention and resources.

Risk assessment helps you understand which risks need immediate attention and which ones can be monitored over time.

In simple terms, risk assessment involves evaluating two main things: how likely it is that a particular event will happen (probability) and what the impact would be if it did happen (severity).

Let’s say you’ve identified a potential risk, like a new competitor entering the market.

Your risk assessment would involve gauging how likely it is for this competitor to impact your business and what the consequences would be.

Would it be a slight inconvenience, or could it seriously shake up your market position?

This process isn’t just a one-time thing. It’s important to keep reassessing risks regularly because things change – new information can come to light, market conditions can shift, and what seemed like a minor risk yesterday can turn into a major one tomorrow.

Risk response is the process of making strategic decisions to manage risks in a way that supports your business’s goals and keeps you on track for success.

Once you’ve figured out the likelihood and impact of a risk, the next question is, “What do we do about it?” Your response can take several forms.

Maybe you decide to dodge a risk entirely, change how you do things to lessen its impact, share the risk (like through insurance), or just accept it as part of doing business.

For example, if you’ve identified a technological change as a potential risk to your operations, your response could be to invest in new tech training for your staff. This way, you’re turning a risk into a chance for improvement.

But here’s the thing: your risk response should align with your overall strategy and risk appetite. It’s about making choices that fit with how much risk you’re willing to take on and what you’re trying to achieve as a business.

And remember, the business environment is always changing, and so are its risks. By staying flexible and ready to tweak your responses as needed, you can navigate these changes more effectively.

Control activities can take many forms, but they all serve the purpose of mitigating risks to an acceptable level.

For instance, if you’re worried about data breaches, a control activity might be implementing stronger cybersecurity measures or regular IT audits.

So, control activities should be tailored to fit your organization’s unique situation. There’s no one-size-fits-all solution.

The controls for a tech company will look very different from those of a manufacturing firm.

Control activities take many forms, including providing clear guidelines for day-to-day operations and utilizing locks, security cameras,

Control activities also involve preventing conflicts of interest and unauthorized access by utilizing technology, systems, and tools that automate monitoring and compliance. and access restrictions.

Another important aspect is that these activities need to be integrated into your day-to-day operations.

They’re not just emergency measures to pull out in a crisis; they’re part of how your organization runs regularly.

This integration ensures that risk management is a consistent part of your business process, not an afterthought.

In the COSO ERM framework, information and communication are like the nervous system of your organization’s risk management body.

Having the right information at the right time is crucial for effective risk management. That’s more like you need accurate, timely data to make the best decisions.

This means not only gathering data about potential risks but also making sure it’s reliable and relevant.

But here’s the catch: having all this information is only useful if it’s communicated effectively. This is where the communication part comes into play.

It’s about making sure that everyone, from the top executives to the front-line employees, understands the risks and what needs to be done about them.

Imagine you’ve identified a new market risk. Your team needs to know about it, understand it, and be clear on how to respond. This requires clear, open channels of communication – whether that’s regular meetings, reports, or digital dashboards.

And it’s not just about internal communication. Externally, you need to communicate with stakeholders like investors, regulators, and customers.

They need to understand how you’re managing risks, which can help build trust and transparency.

Monitoring within the COSO ERM framework is your ongoing reality check. Monitoring helps keep your risk management efforts relevant, effective, and aligned with your ever-changing business environment.

We know it’s not enough to implement risk management processes. Risks can change, evolve, or emerge suddenly in the business world.

So, it is essential to continuously monitor them and the effectiveness of your response strategies.

Monitoring is like a feedback loop that informs you whether your approach is working or if adjustments are necessary.

This continuous surveillance involves regular reviews and reassessments. For instance, if you’ve implemented new cybersecurity measures, monitoring would mean regularly checking to see if they’re effectively warding off threats.

Yes, monitoring is about actively looking for signs of success or red flags that suggest a need for change.

But there’s more to it than just watching the risks. Monitoring also means keeping an eye on how well your organization is adhering to its risk management policies and procedures.

Are the planned activities being carried out as they should be? Are employees at all levels engaged in the process?

As we conclude our discussion, it is clear that businesses and IT projects require an enterprise risk management framework, not only because it’s beneficial, but also because it’s essential.

An ERM framework helps you see the bigger picture of risks. It’s about not just looking at risks in isolation but understanding how they interact and impact your entire organization.

This holistic view is crucial for making informed decisions that align with your overall business objectives. Implementing an ERM framework involves identifying, assessing, and prioritizing risks.

Moreover, a robust ERM framework enhances your credibility. It shows your stakeholders, including customers and investors, that you’re proactive about managing risks.

But it’s not a one-time effort. The business landscape is always changing, and so are the risks. That’s why continuously updating and strengthening your ERM framework is crucial. It ensures your risk management practices stay relevant and effective.

So, let’s prioritize establishing and enhancing our ERM frameworks, ensuring a resilient future for our businesses.